tax credit community meaning

The Work Opportunity Tax Credit or WOTC is a general business credit provided under section 51 of the Internal Revenue Code Code that is jointly administered by the Internal Revenue Service. Tax credits are awarded to eligible participants to offset a portion of their federal tax liability in exchange for the production or preservation of affordable rental housing.

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

SOLVED by TurboTax 256 Updated December 29 2021.

. How To Apply For Low-Income Housing Tax Credit Apartments In Houston. A tax credit is an amount of money that taxpayers can subtract dollar for dollar from the income taxes they owe. For 2021 only the child tax credit amount was increased from.

The Low-Income Housing Tax Credit is a tax credit for real estate developers and investors who make their properties available as affordable housing for low-income. The Low-Income Housing Tax Credit LIHTC program is the most important resource for creating affordable housing in the United States today. A tax credit is an amount of money that taxpayers can subtract dollar for dollar from the income taxes they owe.

A tax credit differs from deductions and exemptions which reduce taxable income rather than the taxpayers tax bill directly. The Low-Income Housing Tax Credit LIHTC subsidizes the acquisition construction and rehabilitation of affordable rental housing for low- and moderate-income tenants. A tax credit differs from deductions and exemptions.

The Low-Income Housing Tax Credit LIHTC program helps create affordable apartment communities with lower than market rate rents by offering tax incentives to the. Until a few years ago the promotion of community economic development in low-income areas had to be. That is if a taxpayer otherwise owes 2000 to the government in income tax but has 1000 in tax credits then the.

Legal Definition of tax credit. A tax credit property is an apartment complex or housing project owned by a developer or landlord who participates in the federal low-income housing tax credit LIHTC program. TAX CREDIT COMMUNITIES 2100 Memorial Drive Apartments 2100 Memorial Houston TX 77007 Phone.

A tax credit is a dollar-for-dollar reduction of the income tax you owe. The NMTC Program incentivizes community development and economic growth through the use of tax credits that attract private investment to distressed communities. 3 Tax Credit Eviction.

An amount that may be subtracted from the sum of tax otherwise due and that is distinguished from a deduction applied to gross income in the calculation of. The Low-Income Housing Tax Credit LIHTC program helps create affordable apartment communities with lower than market rate rents by offering tax incentives to the. Community Tuition Grant Organization.

An amount of money that is taken off the amount of tax you must pay 2. The Health Coverage Tax Credit HCTC is a refundable tax credit that pays 725 of qualified health insurance. Owners and investors in qualified affordable multifamily.

There are two types. For example if you owe 1000 in federal taxes but are eligible for a 1000 tax credit your net liability drops. To provide low-income families with tuition assistance and to offset the cost of tuition for parents who would like the option of sending their child to.

713-587-5000 06 mi Directions. Created by the Tax Reform Act of 1986 the. Tax credits work well in todays community development environment.

A direct dollar-for-dollar reduction of ones tax liability. Tenants living in tax credit buildings have good cause eviction protection statewide. An amount of money that.

Houston Tax Credit Apartments. LIHTC owners are prohibited from evicting residents or refusing to renew leases or. The federal housing tax credit program is a means of directing private capital toward the creation of affordable rental housing.

A tax credit is a provision that reduces a taxpayers final tax bill dollar-for-dollar.

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

State And Federal Tax Credits Agency Of Commerce And Community Development

What Are Tax Credits Turbotax Tax Tips Videos

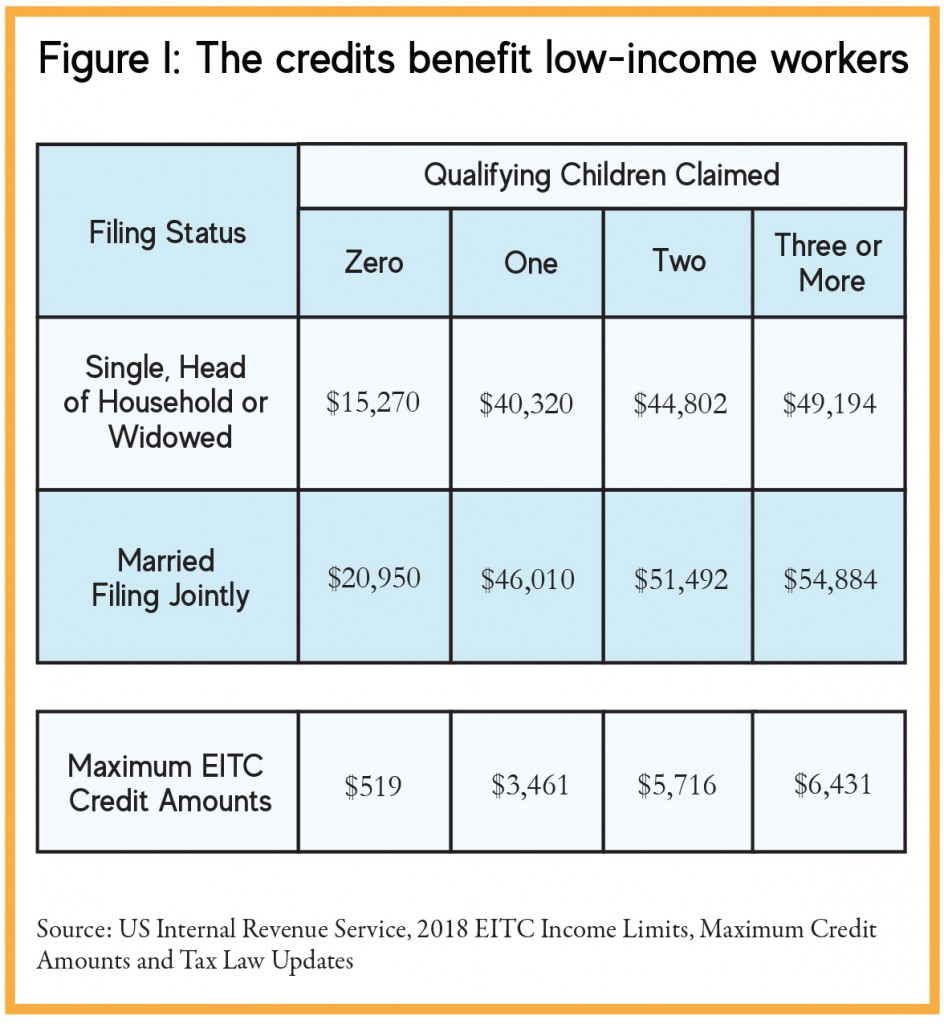

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

Using The Low Income Housing Tax Credit To Fill The Rental Housing Gap Health Affairs

American Opportunity Tax Credit H R Block

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

College Students Are You Getting Your Education Tax Credits The Official Blog Of Taxslayer

Using The Low Income Housing Tax Credit To Fill The Rental Housing Gap Health Affairs

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Employee Retention Tax Credit Office Of Economic And Workforce Development

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center